Since its inception, Digital advertising has been ever expanding with newer and newer media platforms and formats. From simple website banners, it has now evolved into a mainstream advertising channel that includes Display, Video, Audio, Connected TV and DOOH Ads.

While direct media buys with publishers have traditionally been the preferred method for securing premium and reserved inventory, the expansion of digital channels has led to media fragmentation and increased complexities in campaign planning, execution, and reporting.

In response to these challenges, Programmatic Media Buying emerged as a solution to streamline and automate the media buying process. By consolidating all possible media buys into a single platform, it aimed to simplify and enhance campaign management. But does programmatic media buying truly offer added benefits over the direct buying method?

In this article, we will explore the advantages it brings and evaluate its efficacy compared to direct media buying.

When you consolidate your Display and Video buys under one platform, it allows the advertiser to have a universal frequency cap across all the different buys. This ensures that an advertiser does not overexpose with ad to a user from multiple campaigns that he is running. This reduces impressions wastage and results in media savings. These impressions can then be diverted to reach out to more new users with the same amount of investments.

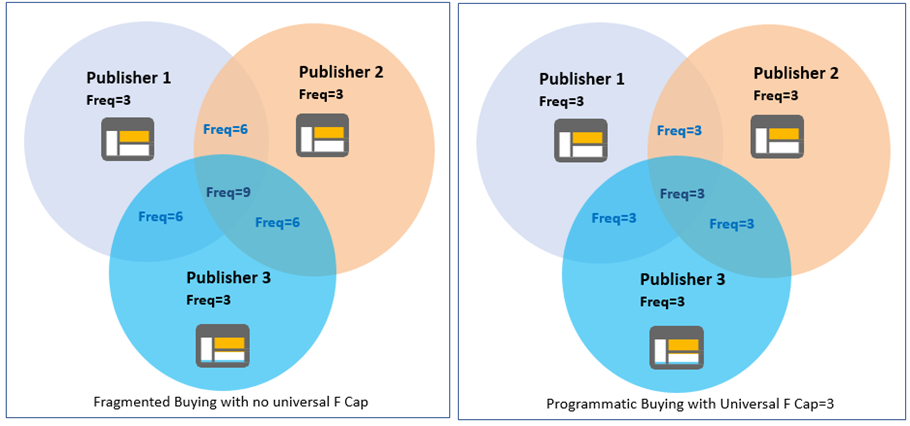

In contrast, when we directly buy media from multiple publishers/platforms, each publisher/ platform will have their own individual frequency cap. In absence of an universal frequency cap, each of the individual platforms will try to deliver its ads with their own individual frequency, potentially leading to the overexposure of ads to a single user. This overexposure not only wastes impressions but also reduces the efficiency of the advertising investment. The below diagram illustrates the frequency management across publishers.

As depicted in the above diagram, with fragmented display and video buying, the overlapped users are getting exposed 3x times the frequency cap whereas in programmatic buying, with a universal frequency cap in place, frequency is controlled reducing media wastage.

According to a study conducted by Google and Nielsen across 10 global campaigns, the programmatic approach drove an increase of 11% in reach efficiency. This means that advertisers were able to reach 11% additional audience with the same amount of investment when compared to direct buys done in Silos. (Source:Google whitepaper)

Performics India witnessed media budget savings ranging from 6% to 21% upon consolidating Display and Video purchases onto a unified platform. Here are a few examples of brands we assisted in achieving their goals through media consolidation:

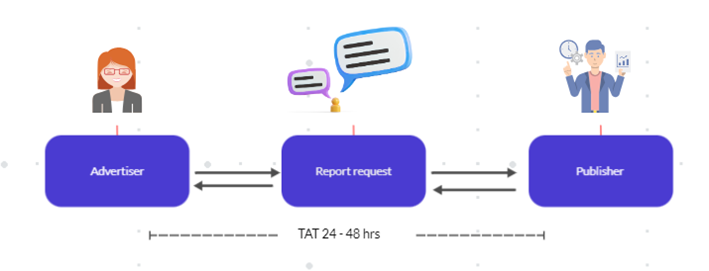

One significant challenge that we face when buying media directly is the lack of real-time campaign report and insights. Without a consolidated view of the campaign, advertisers often rely on reports shared by individual platforms or publishers, which can be delayed and time-consuming to acquire.

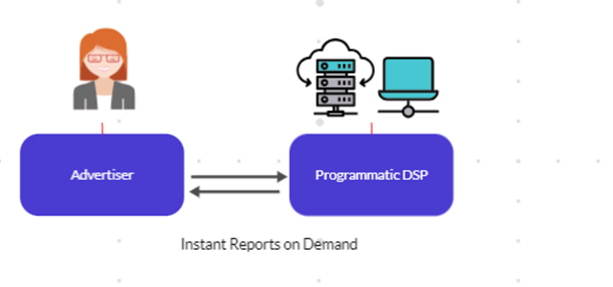

However, by consolidating media buying within a single platform, advertisers can access real-time data for all their campaigns. This centralized view provides immediate and up-to-date information on campaign delivery, allowing advertisers to monitor and analyze performance in real time.

This shift to real-time data not only saves valuable time but also reduces the overhead and effort required to obtain and consolidate reports from multiple publishers.

Programmatic buying platforms have transformed the way advertisers connect with multiple publishers through their integrated marketplaces. These marketplaces offer a streamlined approach, allowing advertisers to access media proposals from various publishers with just a few clicks. This automated process replaces the traditional method of reaching out to publishers individually through phone calls and emails, which was time-consuming and demanded additional effort. By leveraging Marketplaces, advertisers can conveniently browse through the available media options and evaluate proposals from multiple publishers in a central location. This not only saves time but also reduces the additional overheads of negotiating with each publisher separately.

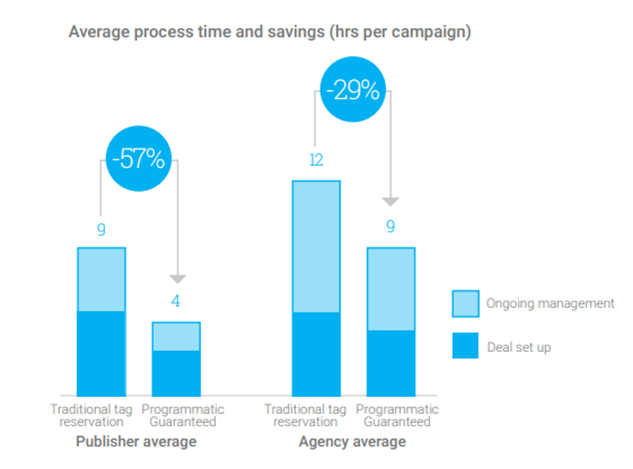

To test the efficiency and time savings brought in by programmatic platforms, BCG conducted a study across multiple partners which included advertisers and publishers. According to study programmatic buy were 29% efficient for Advertisers and 57% efficient for the publishers in terms of time saved when compared to traditional manual buys. (Source: BCG report)

Programmatic platforms offer advertisers a transparent view of their campaigns, providing real-time reporting on key metrics such as the number of impressions delivered and daily spending. This level of transparency allows advertisers to closely monitor and track the performance of their campaigns, ensuring they are on target with their media plans.

Furthermore, programmatic platforms provide access to additional reports within the demand-side platform (DSP). These reports offer valuable insights into various aspects of campaign delivery, including viewability, ad placement, time of the day performance etc. By leveraging these reports, advertisers can verify if their campaigns are aligning with the initial brief and media plan, enabling them to make data-driven adjustments and optimizations as needed.

While the above benefits are very promising. The programmatic approach has certain challenges as well. Below are some of the challenges:

1. Programmatic adoption: Not all publishers have embraced programmatic advertising and continue to sell their inventory directly. This lack of uniform adoption hampers the efficiency of campaigns and reduces the benefits of media consolidation. Without full participation from all publishers with all ad formats, it becomes challenging to leverage the advantages of programmatic advertising.

2. Resistance to share user level data: Some publishers do not share their cookie-level data with programmatic systems. This data is crucial for accurately identifying unique users and managing frequency capping and this may hamper the overall efficiency of the campaign.

3. Deprecation of third-party cookies: The deprecation of third-party cookies and mobile device identifiers poses a significant challenge to media consolidation. These identifiers have been the key for tracking users across different platforms and enabling effective frequency management. With the sunsetting of third party cookies and mobile device id’s, alternative measurement methods & identifiers need to be adopted. All major Programmatic DSPs are developing their tech stack to manage this better and it would be a good space to monitor and learn.

From the above pointers it is clear that programmatic media consolidation has benefits over the traditional direct media buying. Advertisers can not only maximize the efficacy of their investments but also make faster data-driven decisions, optimizing their campaigns on the go. To start your programmatic journey feel free to reach out growth@performics.com