What is DTC?

Direct to Consumer brands have been growing at an astonishing rate with no slowdown in sight. But DTC is evolving and its definition now supersedes the original digital disruptors that coined the phrase.

The retailers, CPGs and consumers have been captivated by these companies. The products are innovative or solve problems for customers. Their back stories are inspiring, often with a social mission that appeals to shoppers, particularly younger ones. And the brand promise of offering a higher quality product at lower prices, thanks to a more efficient sales model that cuts out layers of costs, promises a compelling value proposition.

But these DTCs are still relatively small. Few are valued at $1 billion, namely Allbirds, Casper Mattresses and Warby Parker. Dollar Shave Club was acquired by Unilever for $1 billion and others have been sold to established brands for large sums including Bonobos, which Walmart snapped up for $310 million.

DTCs are best defined by one of the originators: Casper. The mattress company launched online, sold direct to consumers through its own platform and then began opening stores in order to speed customer acquisition. It’s a similar story for Warby Parker, the online eyewear company. Both brands proved so popular, that they gave rise to a host of similar or copycat brands, and pushed changes at existing brands to lower prices and streamline sourcing. (One of the hallmarks of a DTC is a message of transparent production and pricing – that cutting out the retailer removes a costly component and lets the brand charge less.)

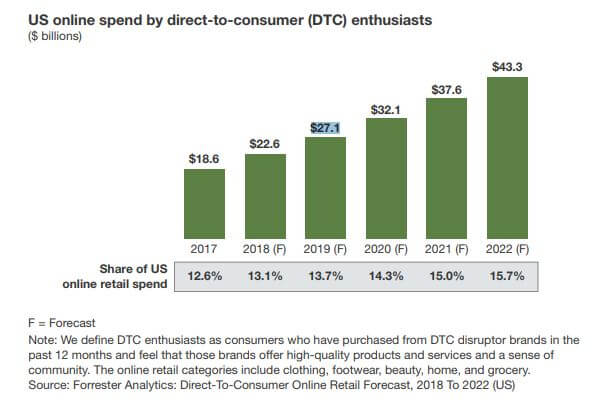

A recent Forrester Marketing Conference held in New York April 1-3 titled Beyond the Direct-to-Consumer Revolution posed the question: Are we at peak DTC yet? The answer is overwhelmingly no. DTC is more important to the CPG landscape then ever, and it’s important to note just what DTC means today.

DTC’s do good works DTC’s do good works

Giving back is another DTC hallmark. For many of these brands, something is donated for each purchase made. Some follow the model set by TOMS footwear – buy one give one – that gives a like item to a person in need for each one bought by a consumer. Some food or CPG brands are donating meals. It’s a model proving popular with consumers who increasingly choose a product based on a charitable cause or giving principal. In a recent Forrester survey, 41% of customers said they were interested in purchasing from a company that is associated with a social, environmental or political issue they care about.

Notably, charity wasn’t the most cited reason for shopping a brand but landed in the middle, tied with an eagerness to buy from a brand with an interesting entrepreneurial story. This further highlights the need for marketers to tell those stories and connect with consumers in the areas, interests and moments of intent that check these boxes.

.

DTC is growing up

Time was, the term applied largely to digitally-native brands that sold direct to consumers, bypassing traditional merchants. But that changed quickly as brands hosted pop-up shops, opened physical stores and partnered with existing retailers.

Today, there are more DTC brands than we can count – and perhaps more that never got off the ground or gained critical mass. In 2018, Tim Armstrong, former head of Google ads and CEO of AOL, launched a new entity called the dtx company to invest in DTC brands. According to Armstrong, there’s a DTC challenger product out there for just about any established brand sold today.

While not every DTC is a stand-alone business, each of these brands can reach a level of success on the evolving DTC spectrum. For example, Native is an all-natural deodorant that has expanded into toothpaste and body washes. Would a stand-alone Native store make sense in the physical world? Likely, no. But Native has hosted pop-ups inside established retailers and is now sold as a brand alongside traditional CPGs at Target and Walmart. Quip toothbrushes have also taken this route – selling online and in select stores although consumers must go online to subscribe to a replacement program. (And retailers are reportedly getting a percentage or commission from each subscription they send Quip’s way, reminiscent of the early model of mobile phone sales where the retailer sold the hardware, got a percentage of the monthly bill kicked back by the carrier).

Armstrong is focused on DTC for three reasons:

• All the companies are establishing direct relationships with the consumer in a variety of product categories and means. One, Dirty Lemon, uses only text messaging to connect to customers

• He’s investing in “unit economics” – these brands have a handle on net costs and know what works

• All have founders who are obsessed with the product and category, not the money

What is the DTC endgame?

Part of growing up is evolving, or selling out. Many are being acquired by established brands like Walmart, or partnering with others such as Nordstrom, which hosted collections by Away and Allbirds in the last few months. Strategies will differ – Walmart is housing their acquisitions largely under its Jet.com banner while Nordstrom President Erik Nordstrom told Shoptalk attendees in March that he had no interest in buying brands, but prefers to host revolving shops within the store.

Many choose to open brick and mortar locations, roughly 850 of them will open in the next five years, according to one study. New businesses are being created to support this new DTC ecosystem. Brandbox has created to serve a modular retail space designed to ease digital natives in the physical world in a lower-risk way and Showfields debuted in New York for the 2018 holiday season featuring a slew of DTCs such as Boll & Branch bedding, Function of Beauty and Quip. And finally, many DTCs will be acquired and the rare few will go public.

Legacy brands go DTC

An entirely new kind of retail model is emerging around the DTC phenomenon. The term is now being applied far more liberally than to just digital natives. Well established legacy brands are talking about going direct to consumers in ways that require new marketing, messaging, platforms and product development. They are breaking away from traditional methods.

Coty’s Covergirl has a stand-alone store in New York’s Times Square and launched a Shop Covergirl website for DTC sales. Fender Stratocaster, a 55 year old brand, is solving its customer retention problems by going DTC with personalized products that have proven popular with women, their fastest growing customer base who also happens to dislike the in-store experience.

McDonalds is talking about DTC in terms of how they connect with and identify customers. It recently purchased personalization technology company Dynamic Yield for $300 million to do just that. The technology will help McDonald’s identify what customers are interacting with beyond the McDonald’s brand. The quick-serve chain launched a mobile app just four years ago and this was the brand’s first attempt to connect directly to the customer, which is how McDonald’s and other legacy brands are interpreting DTC.

Data is the DTC currency

Data is what builds and drives DTC and digitally native brands are data-first. They develop algorithms, mine customer information and leverage AI and machine learning to fine-tune marketing and develop new products. It’s a bargaining chip that DTCs bring to the table in partnership and acquisition talks.

Foot Locker in February, invested $12.5 million in Rockets of Awesome, a DTC brand that sells kids’ apparel (founded by Rachel Blumenthal, spouse of Warby Parker co-founder Neil Blumenthal). It’s just one of the companies Foot Locker is investing in and data is a big reason why. “A nimble environment, machine learning, data … these are all things we can share,” notes Blumenthal. “DTC brands are built on the bedrock of data to create highly-tailored, highly-functional solutions,” according to Forrester’s Dipanjan Chatterjee, VP and Principal Analyst.

Are DTC’s reaching critical mass?

Not even close, according to industry insiders. Investors are lining up to fund these ventures, legacy brands and large companies are investing in or acquiring them, and new business models are being developed to serve and amplify the growing army of DTC brands.

“DTC will end up being a very significant part of the future,” believes Armstrong. “There are so many companies you’ve never heard of. There isn’t a DTC ceiling.”

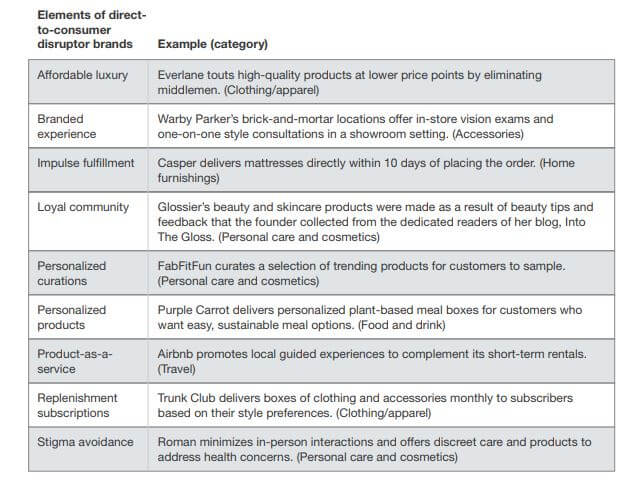

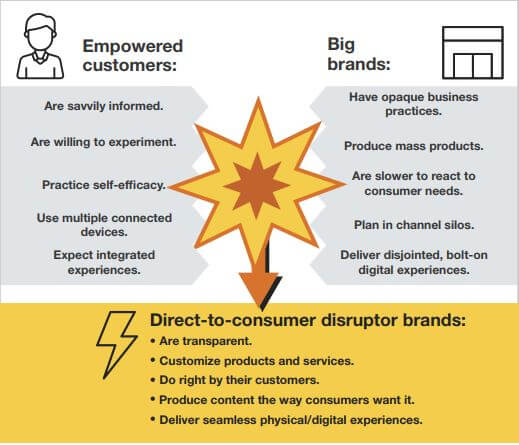

DTC’s Impact on Brands

Source: Forrester

Footnote on Subscriptions

Subscription services – everything from Stichfix to Hello Fresh – are often included in this category, and for good reason. They launched online, have direct relationships with their customers and rely heavily on social media and influencers for marketing. These brands are delivering value to consumers and, while not as popular as individual DTC brands according to Forrester’s research, they bring an excitement, loyalty and opportunity that legacy brands sorely need.